Andrew Hallam

17.06.2019

The Global Permanent Portfolio: Is It The World’s Most Stable Investment?

_

Neanderthals were probably pretty tough. In a no-hold’s-barred cage match, my ancient ancestors could have pummeled me to a pulp. Unless you’re a mixed martial artist, you might be equally outmatched. But we have something the ancient ones didn’t: a much bigger brain. Unfortunately, despite the added cerebral juice, our brains haven’t evolved as much as we might think. We run towards perceived opportunity and we run away from perceived danger. But such perceptions are often out of whack.

When investing, this often gets us into trouble. We often sell (or cease to add fresh money) when our investments have dropped. And we confidently pour money into the markets after our investments rise. This causes the average person to buy high and sell low.

Harry Browne knew that. That’s why the investment writer and politician created The Permanent Portfolio in 1981. It promised smooth investment returns, and it wasn’t supposed to crater when stocks hit the skids. In other words, it was designed to control our inner Neanderthal.

Harry Browne didn’t say it would beat a portfolio comprising 100 percent in stocks. Nor did he claim it would beat a portfolio of 60 percent stocks and 40 percent bonds. But over long time periods, it has proven to be stable. It requires a four-way split between stocks, long-term bonds, cash (or short-term bonds) and gold.

OK, I can already hear you groan. Long-term bonds pay paltry interest. If inflation rates rise, they could lose to a box of breakfast cereal. Cash is for fools because it doesn’t make money. Gold is a dud. If you bought $1 of gold in 1801, and you sold the proceeds today, you could barely fill the tank of your family’s mini-van. Some of you might even think stocks are for suckers. Perhaps this long bull market is finally running on fumes.

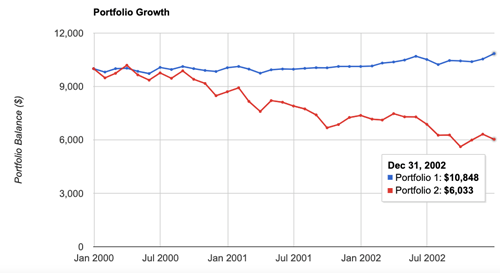

However, none of that should matter. Harry Browne didn’t design The Permanent Portfolio to win a popularity contest. Instead, he created something that he hoped would always prosper. Consider the horrific market crash from January 2000 to January 2003. Global stocks plunged 12.94 percent in 2000. In 2001, they fell another 15.28 percent. If that wasn’t bad enough, in 2002, global stocks cratered another 18.20 percent.

Instead of falling hard over those three horrific years, Harry Browne’s portfolio actually made money. Browne’s original model only included U.S. stocks. But because ETFs are now available on multiple stock exchanges, the portfolio can go global. The Global Permanent Portfolio would include a global stock ETF, a gold ETF, a long-term bond market ETF and a short-term bond market ETF. According to portfoliovisualizer.com, over those same three years (2000, 2001 and 2002) The Global Permanent Portfolio gained 3.39 percent, 1.55 percent and 2.38 percent respectively. In other words, a global stock market index would have dropped almost 40 percent over this three-year period. By comparison, The Global Permanent Portfolio would have gained almost 8.5 percent.

The Global Permanent Portfolio versus Global Stock Market Index

January 2000-January 2003

Source: portfoliovisualizer.com

Note: This portfolio comprises the following, in equal proportions: a global stock ETF, gold ETF, a U.S. short-term bond market ETF and a U.S. long-term bond market ETF. It was also rebalanced once a year.

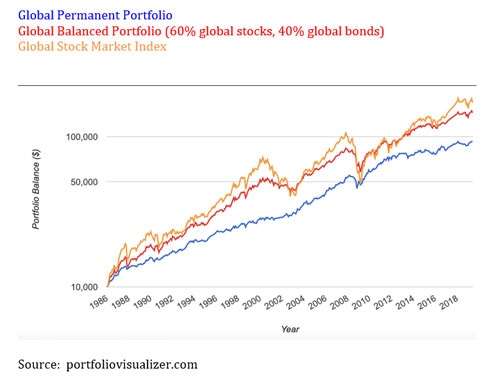

Over the 32 years between 1986 and 2019, a global stock index would have beaten The Global Permanent Portfolio. The stock index would have averaged about 8.82 percent per year. But The Global Permanent Portfolio wouldn’t have shamed itself. It would have averaged a compound annual return of 6.89 percent. It would have also been a lot easier on the nerves. Over this 33-year period, its worst single year performance was a drop of about 4.22 percent in 2013.

You might wonder how it handled the crash of 2008. Surprisingly, it dropped just 1.58 percent. That compares to a plunge of about 40.38 percent for the global stock market index.

Why Does It Work?

The Permanent Portfolio works because it’s diversified across asset classes that often move in opposite directions.

Economically, just four configurations exist:

1. Prosperity

2. Deflation

3. Recession

4. Inflation

Prosperity is great for stocks and sometimes bonds. It’s a period of rising productivity and optimism. It’s when investors pour money into the markets, perceiving even greater times ahead. During periods of prosperity, however, gold is as out-of-step as a waltz at a rave. It’s most popular among hoarders expecting to trade gold bars for bread during catastrophic economic meltdowns. As a result, gold buyers hibernate when economies hum.

Deflation is much better for long-term bonds and cash. Stocks usually underperform as corporate profits get squeezed. Cash is king, as purchasing power increases each year with falling product prices. Stocks usually stink during deflationary periods, as does gold.

Recessions dampen most asset classes. But they’re often short-lived. Interest rates often rise as the economy contracts. That causes bonds to perform poorly. Gold and stocks often disappoint, leaving cash once again, the portfolio’s salvation. Inflation is great for gold. When currency values diminish, fears of paper assets mount. Sometimes stocks do well under such conditions; sometimes they don’t. But historically, gold has offered the greatest purchasing power protection when inflation rears its head.

While four economic conditions exist, you’ll never predict what’s coming next. And nor, with any degree of consistency, will anyone else. Owning everything, and rebalancing once a year, has produced stability over time. And if The Global Permanent Portfolio can collar your inner Neanderthal, it just might be worth it.

If you would like to create your own Global Permanent Portfolio, I’ve listed some examples below. In each case, I’ve included some home-country currency bias. To date, neither iShares nor Vanguard offers a short-term or long-term global bond market index.

Global Permanent Portfolio For Canadians

| Allocation | ETF Symbol | Fund Name |

|---|---|---|

| 25% Stocks | VCN | Vanguard FTSE Canada All Cap |

| VXC | Vanguard FTSE Global All-Cap ex | |

| 25% Long-term bonds | XLB | Shares Core Canadian Long Term Bond Index ETF |

| 25% Cash (or short-term bonds) | XSB | iShares Core Canadian Short Term Bond Index ETF |

| 25% Gold | CGL | iShares Gold Bullion ETF |

Note: Each of the above ETFs trades on the Toronto Stock exchange. They are each priced in Canadian dollars. Canadians could split their stock allocation between the Canadian stock index and the global stock index: 10% in the Canadian stock index and 15% in the global stock index.

Global Permanent Portfolio For Euro-Zone Europeans

| Allocation | ETF Symbol | Fund Name |

|---|---|---|

| 25% Stocks | VWRD | Vanguard FTSE All-World |

| 25% Long-term bonds | IBGL | iShares Euro Gov't Bond 15-30 yr |

| 25% Cash (or short-term bonds) | IEGE | iShares Euro Gov't Bond 0-1 yr |

| 25% Gold | SGLN | iShares Physical Gold |

Note: Investors could also add a European stock market index to their stock market allocation, perhaps including about 5% in European stocks and 20% in global stocks. The global stock index already contains European stocks within it, so the investor shouldn’t invest too heavily in an individual European stock index. When rebalancing, investors should also note that the gold index is priced in USD and the global stock index is priced in GBP. As a result, investors should determine gains or losses in a single currency (any currency, as long as it’s consistent). This will allow them to rebalance accurately. For more details on rebalancing a multi-currency priced portfolio, see the book, Millionaire Expat (Wiley 2018).

Global Permanent Portfolio For British Investors

| Allocation | ETF Symbol | Fund Name |

|---|---|---|

| 25% Stocks | VUKE | Vanguard FTSE 100 ETF |

| VWRD | Vanguard FTSE All-World | |

| 25% Long-term bonds | IGLT | iShares Core UK Gilts (average maturity as of this writing: 15.97 years) |

| 25% Cash (or short-term bonds) | ERNS | iShares Euro Gov't Bond 0-1 yr |

| 25% Gold | SGLN | iShares Physical Gold |

Note: Investors could buy the British stock index and the global stock index. They might allocate 10% to the British stock index and 15% to the global stock index. Each of these ETFs is priced in GBP, with the exception of the gold market index, which is priced in USD. As a result, at the end of each year, investors should determine the gain or loss for the gold index in GBP. This will make rebalancing the portfolio accurate. For more details on rebalancing a multi-currency priced portfolio, see the book, Millionaire Expat (Wiley 2018).

The data from the performance tables below are courtesy of portfoliovisualizer.com. To determine short-term and long-term bond market performances, I used U.S. bond market indexes.

| 5 Year Periods | 5-Year Returns Global Permanent Portfolio | 5-Year Returns Global Balanced Portfolio | 5-Year Returns Global Stocks |

|---|---|---|---|

| 1986-1990 | 9.34% | 12.68% | 14.71% |

| 1990-1994 | 5.14% | 6.36% | 4.86% |

| 1994-1998 | 5.90% | 11.90% | 14.72% |

| 1998-2002 | 4.55% | 2.98% | -1.77% |

| 2002-2006 | 10.41% | 9.35% | 11.49% |

| 2006-2010 | 9.63% | 6.08% | 3.74% |

| 2010-2014 | 6.20% | 8.23% | 10.35% |

| 2014-2018 | 3.08% | 3.74% | 4.60% |

January 1986-May 31, | January 1986-May 31, 2019 | January 1986-May 31, 2019 | |

| Compound Annual Returns | 6.89% | 8.31% | 8.82% |

| 7 Losing Years | 8 Losing Years | 9 Losing Years | |

| 1990 -0.51% | 1990 -4.91% | 1990 -14.87% | |

| 1994 -1.27% | 2000 -7.53% | 1992 -2.12% | |

| 2001 -0.63% | 2001 -8.07% | 2000 -12.94% | |

| 2008 -1.58% | 2002 -2.46% | 2001 -15.28% | |

| 2013 -4.22% | 2008 -25.2% | 2002 -18.20% | |

| 2015 -3.43% | 2015 -2.51% | 2008 -40.36% | |

| 2018 -3.04% | 2018 -7.16% | 2011 -6.34% | |

| 2015 -1.90% | |||

| 2018 -9.57% |

Global Permanent Portfolio Proves Long-Term Stability January 1986-May 31, 2019

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.